Rachel Whitney

Curator, Sapulpa Historical Museum

This week in Sapulpa history in 1913, banks of Oklahoma State Bank and Farmers and Merchants Bank made the headlines: one for its closing and one for its trial in court.

On January 16, 1913, the Oklahoma State Bank posted a notice on its door that it was closed. A post was noticed on the bank door that the bank “had been consolidated with the Sapulpa State Bank.” The banking board said the bank was being liquidated and that depositors were directed to the Sapulpa State Bank, where their accounts could be verified and checked.

A “Mr. Dennis” of the banking board stated, “the Oklahoma State Bank and the banking board had agreed with the Sapulpa State Bank to liquidate the affairs of the former and by this agreement, the Sapulpa State Bank has assumed the payment of individual deposits but not other liabilities of the institution.”

After the closing of this bank, the banking board assigned John F. Egan to collect its money. The bank has had issues before, and the Oklahoma State Bank had decided to close before they went under for good. The bank had only opened in November 1910 and had been organized to succeed the Creek Bank and Trust Company.

Mr. Egan had said he would rather close the bank rather than have the risk of losing the money of his depositors. His decision to close turned out to be beneficial, not only to the community, but it ensured trust in him. He was hired by the State Banking Board for his swift decision-making.

However, the town barely stirred from this closing. “The affair caused some little excitement in the city, coming as it did at the time when two of the officers of the [Farmers and Merchants] Bank were having a hearing in the district court on a contempt charge for failure to produce certain books and papers.” The town had their attention on this bank, instead.

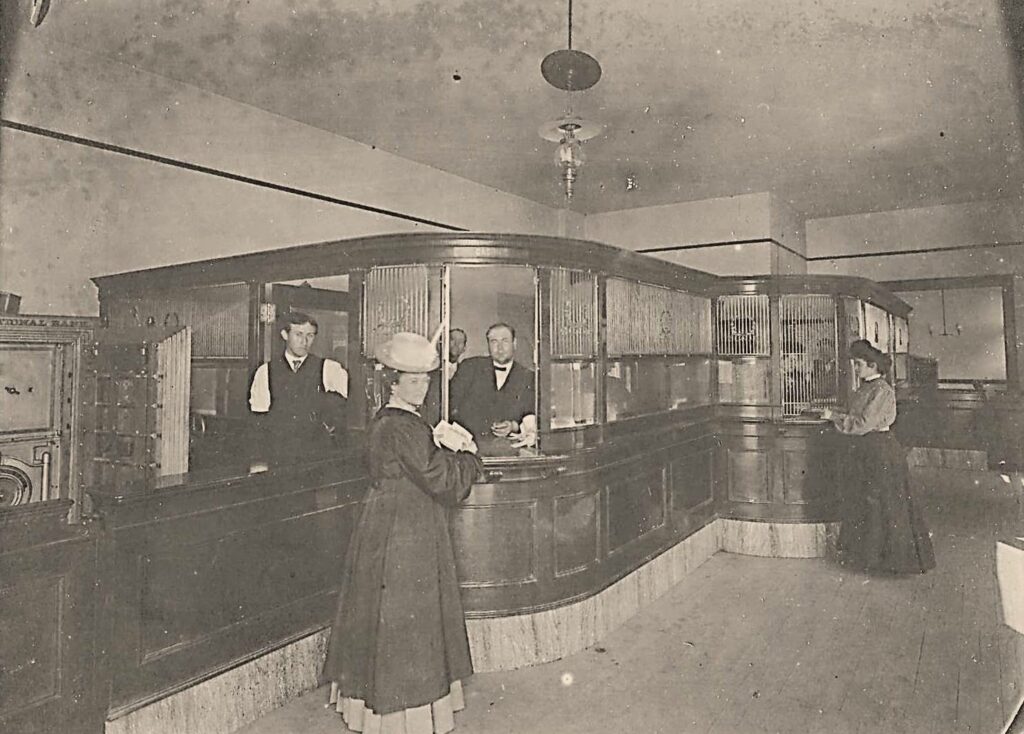

The Farmers and Merchants Bank opened in 1904 on the northwest corner of Dewey Ave and Main St. It was often referred to as “F. and M. Bank”. It was owned by the Burnetts. Instead of closing, the Burnetts created possibly Sapulpa’s first town scandal.

On January 15, 1913, the Burnett brothers, Bates and Birch, were held in contempt of court by Judge Huston. Bonds were “fixed at $3,000 each and ten days given to comply with order.*”

*Note: $3,000 in 1913 is equivalent to nearly $77,000 today.

The Burnetts believed “the court had no right to compel them to return books which might incriminate them in case there were criminal proceedings.” Many eyewitnesses and accounts were narrated in court.

“C.W. Wills was the first witness. He had been with the bank for years, but couldn’t tell the names of the directors.” Another story stated, “Brooks Burnett was the collector. He wasn’t paid by the bank. [He] took a vacation in August and never went back.” Another story stated, “H.E. Killibrew, bookkeeper, told of his duties and said all of the books he worked were there the night the bank closed…didn’t know what became of the old ones…don’t know where they are now or how they go away, if missing.”

During the bill of discovery, it was noted that employees knew little or nothing at all about the working of the bank. The so-called directors were elected, but without their consent, and were, therefore, never notified of meetings. “S.C. Nigh said he had nothing to do with the bank management,” but was a stockholder, and “never attended any meetings; knew he was a director but never gave his consent to be elected; knew nothing of the bank affairs in any manner, and did not attend or even receive notice of directors meetings.”

A “Mr. Patton,” a representative of the banking board, testified, “…one of the many reasons for closing the bank was the large note increase, and thousands of dollars of checks in the drawer as cash items. He read a long list of note increases running up into the tens of thousands, nearly all of which went to companies in which the bank was interested.”

The argument stated a theory that “the bank had been looted and that books were missing.” The statement came from Attorney Lytle that “defendants in their answer said they could not produce the books but if they did they would incriminate themselves.”

Judge Huston reviewed the position of counsel. “He said that so far as the evidence was concerned, it was conclusive that Bates and Birch Burnett had the active management of the bank, and that the books were there when the bank closed. They were responsible for the books and having been ordered to produce them…there is no contention of burglary or some reasonable excuse; they must produce them.”

Bail was set for each man, then. “In a very few minutes after recess both Mrs. Bates and Mrs. Birch Burnett furnished the $3,000 bonds and [they] were released.” However, it was not long before the court convicted the Burnetts. The Burnetts spent 90 days in jail after their conviction. Bates Burnett destroyed his reputation as a banker, but was able to overcome his disgrace with his investments in the oil businesses.