Frank Crawford from Crawford & Associates was present at April 19th’s City Council study session to present the City’s audited financial statements for 2019-2020.

Crawford condensed the 128 page statement into a 30-page “Performeter,” which is “an analysis that takes governmental financial statements and converts them into useful and understandable measures of financial performance.”

Crawford and his brother created the Performeter system, which includes “financial ratios and a copyrighted analysis methodology…used to arrive at an overall rating of 0-10. The overall reading is a barometer of the City’s financial health and performance.” Sapulpa’s rating is a 6.4, which hovers between “Satisfactory” and “Excellent.”

Crawford explained that “no government will ever score a 10 across the board, nor a 0.”

Councilor Brian Stephens asked, “What’s the benchmark?” Crawford replied that he’d like to see the overall score “about a 7.” City Manager Joan Riley said, “[Finance Director Pam Vann] and I are working to get our number to a 7.5.” Crawford said, “You’re very conservative…that usually provides a favorable result.”

On the Summary Page, Sapulpa’s overall score was broken down into three factors—financial position (6.1), financial performance (8.0), and financial capability (4.3). The report states that Sapulpa is “showing improvements in each year.”

Crawford said that, “Sales tax came back up a bit because residents were buying locally” and that our “overall scale has been inching up over the years.”

Capability has to do with the “ability to accrue debt or raise sales tax—the fund balance increase, cash flow increase, and sales tax increase…bumped up Sapulpa’s capability a little bit.” Crawford added that most municipalities “struggle with capability in Oklahoma.”

Regarding the page on the Level of General Fund Unassigned Fund Balance, or carryover, Crawford explained that Sapulpa scored 8% for 2020, but that he’d “like to see it at a minimum of about 10%.” That balance “can disappear just like that with big storms, emergencies, etc. If you want to score a 10 you’ve got to be around 25%,” he said.

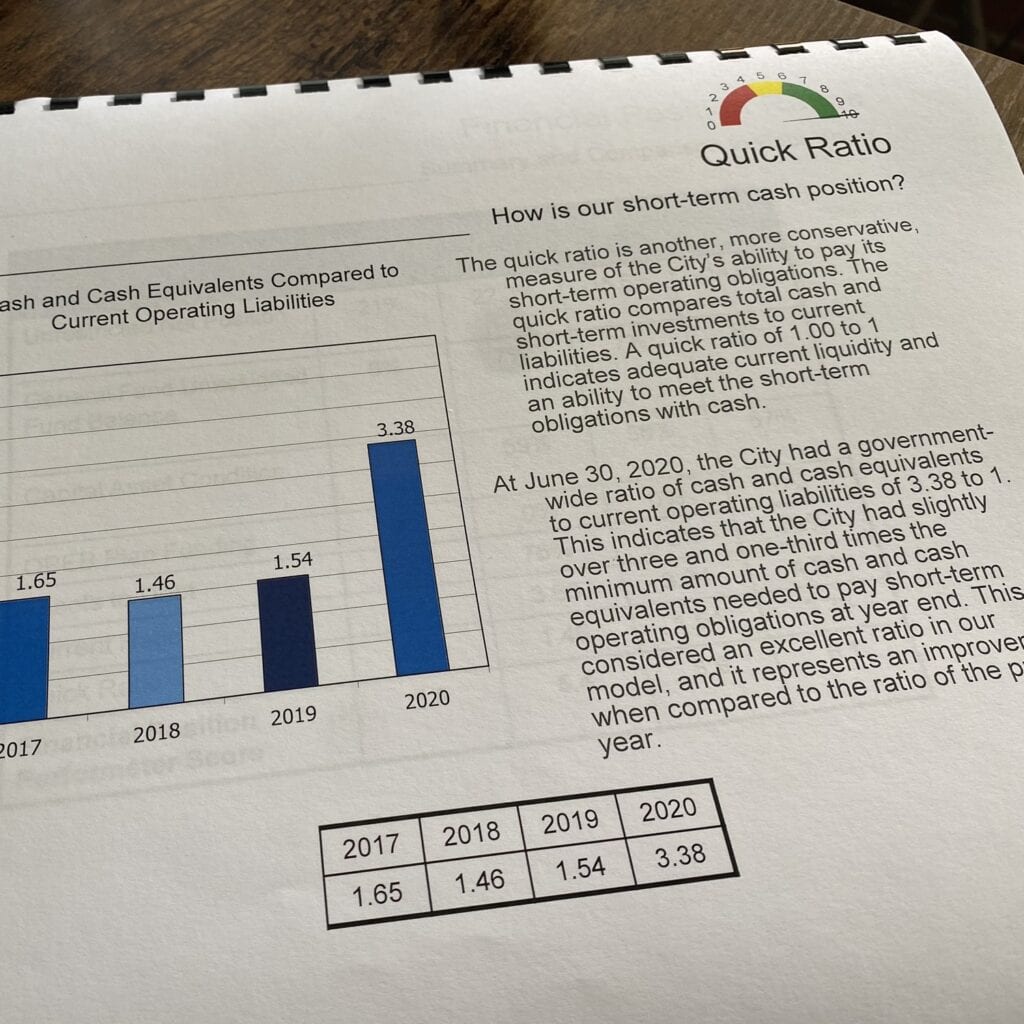

On a positive note, Sapulpa scored “10s on both cash flow ratios,” the Current Ratio and Quick Ratio. “No vendors or employees go unpaid here” and we have “significant amounts of cash flow,” Crawford reported.

The City also “scored really well” on the Performeter’s Financial Performance Ratios, which measure Change in Net Position, Interperiod Equity, BTA (Business-Type Activities) Self Sufficiency, Debt Service Coverage, and Sales Tax growth.

An area in which the City can improve is with its Financial Capability Ratios. Our score is improving (4.3% at the end of 2020 compared to 3.6% at the end of 2019), but still has room to become stronger. These numbers have to do with “sustainability—can you grow your revenue streams? Can you build or rebuild infrastructure?” said Crawford.

Councilor (and banker) Hugo Naifeh asked Crawford, “How are we doing compared to other communities near us?” Crawford said that we are currently, “very comparable to Broken Arrow. Sand Springs has a slightly higher score. But on average, most municipalities are in a similar situation with you, such as Edmond, El Reno, and Owasso.”